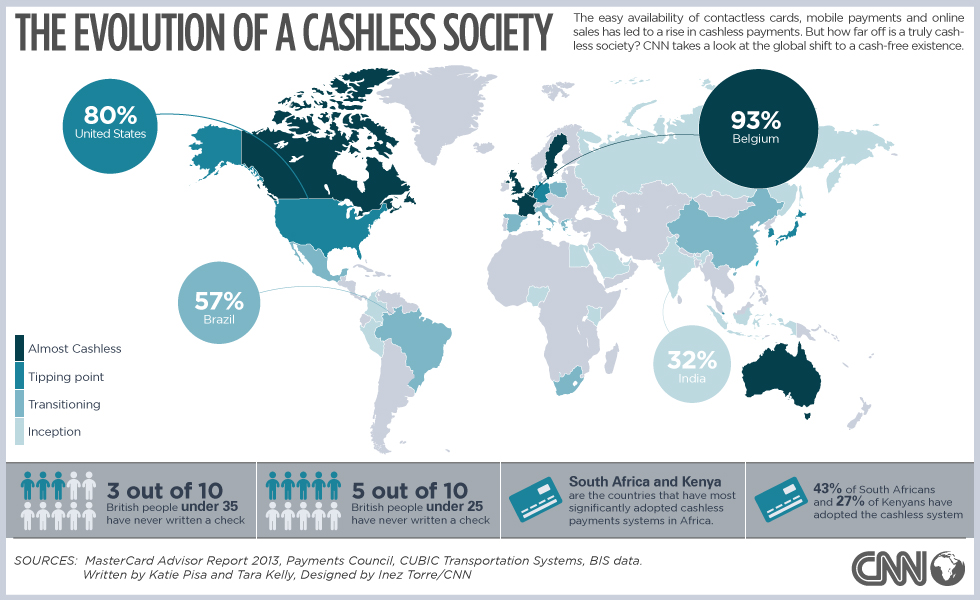

Scandinavia is fast becoming the world’s most cashless society, where many businesses will not accept cash. Economists predict that Scandinavia will eliminate cash by 2030.

In a report titled “A world without cash: The impact of the rise in electronic payments,” HSBC Global Economist James Pomeroy wrote,

“Some countries are moving away from cash payments quite quickly. While Sweden has created the blueprint, we’re seeing similar trends in smaller economies such as Denmark, where ATMs are in sharp decline, in Norway where the aim is to be cashless by 2030, in Finland where prepaid cards are helping to integrate refugees, and in Estonia where plans to move cashless have been in place since 2010. The Netherlands, an early mover in terms of future technology adoption, has many stores that won’t take cash.”

Likewise, in 2016, the Heisenberg Report observed,

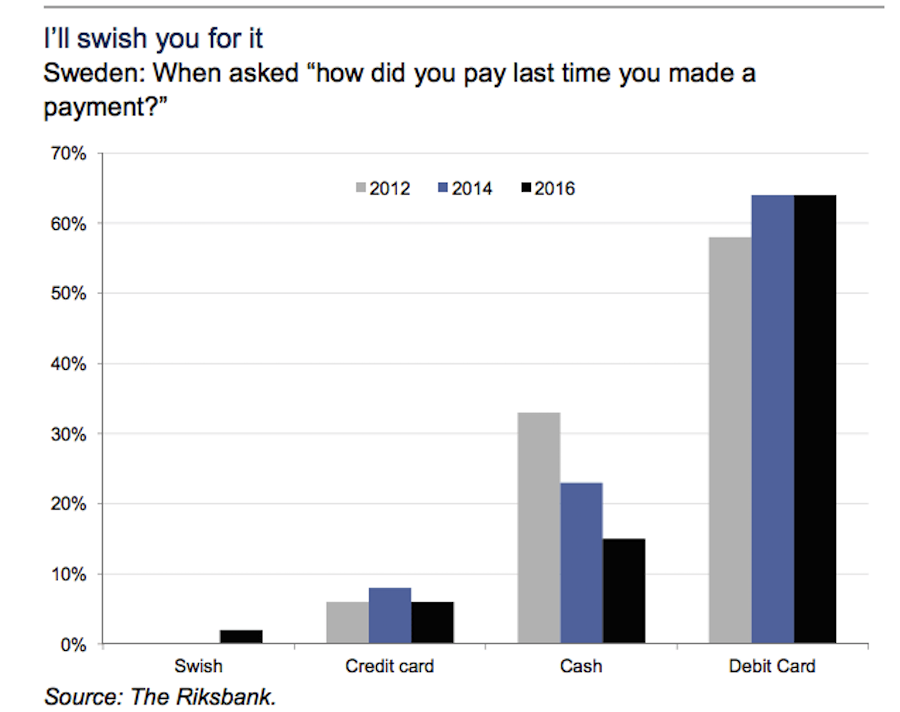

“Scandinavian countries are on the cusp of becoming some of the first cashless societies, as a result of industry-co-ordinated steps and government initiatives. Swish, a payment app developed jointly by the major Swedish banks, has been adopted by nearly half the Swedish population, and is now used to make over nine million payments a month. About 900 of Sweden’s 1,600 bank branches no longer keep cash on hand or take cash deposits and many, especially in rural areas, no longer have ATMs. In conjunction with that, cash transactions were just c.2% of the value and 20% of the volume of all payments made last year (down from 40% five years ago).”

In 2015, Credit Suisse painted the following picture:

“There is no longer any cash. No matter where you are or what you want to purchase, you will find a small ubiquitous sign saying “Vi hanterar ej kontanter.” (“We don’t accept cash.”) Whether it’s for mulled wine at the Christmas market, a beer at the bar, even the smallest charge is settled digitally. Even the homeless vendors of the street newspapers Faktum and Situation Stockholm carry mobile card readers….

Invest Now or Regret Later: What’s Going to Happen in America in the Coming Days!

Four out of five purchases here are made electronically. Plastic dominates, particularly in the retail sector, where 95 percent of all sales are handled with cards….

The six largest Nordic banks (with the exception of the merchant banks) have been gradually weaning themselves off cash since 2010. The citizens have embraced this move as if it were the most natural thing in the world. Between 2010 and 2012 alone, more than 500 branches went cash-free. During that same time 900 cash machines were removed, which resulted in the second-to-worst cash machine coverage in Europe.”

Covert Geopolitics described the situation as follows:

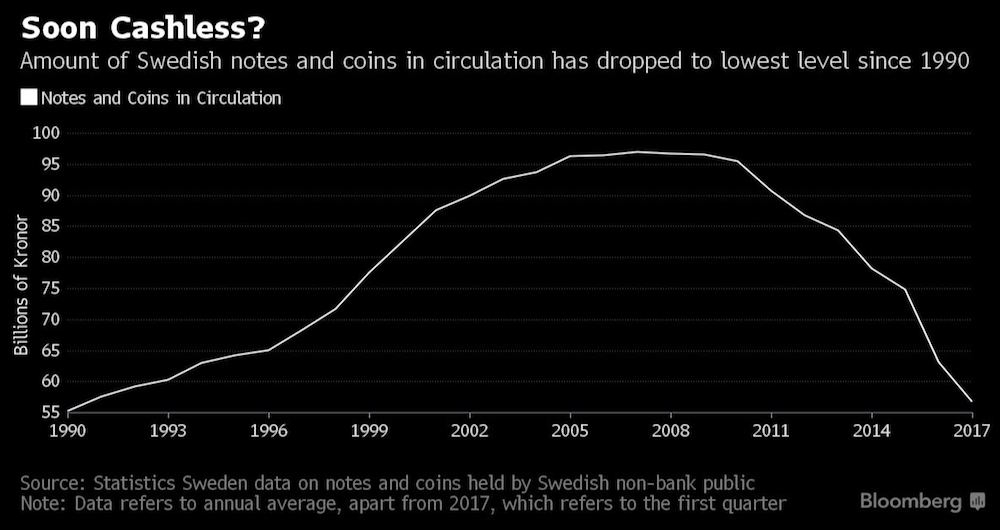

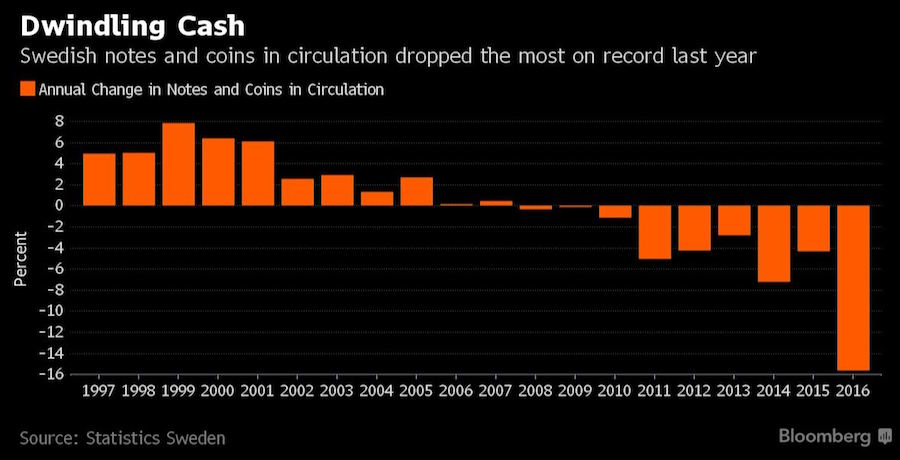

“Last year Stockholm’s KTH Royal Institute of Technology released a report stating that the country is on track to completely eliminating cash transactions in the foreseeable future. Noting that there are now only 80 billion Swedish crowns in circulation in the economy (down from 106 just six years ago), the report highlights how digital person-to-person payment technology “Swish” (developed in collaboration with Danish banks) is already transforming the country’s banking sector, where there are now entire banks that do not accept cash.”

HSBC global economist James Pomeroy described the phenomenon in a recent note to investors: “Sweden is slowly becoming a cashless society, with more than 95% of retail sales made with electronic payment.” Most banks, by far, do not allow customers to withdraw or pay in cash over the counter. SEB, one of Sweden’s largest banks, refuses to handle cash in all except seven of its 118 branches. Payments using cash are down to one percent of the national economy, and locals rarely use cash. You have to use a credit card or a smart phone to pay for a cup of coffee or a bus ride.

According to Sweden’s central bank, cash payments in the retail sector have fallen from 40% in 2010 to 15% in 2016; and 59% of consumer transactions are completed through non-cash methods. Even in church, the collection is taken in plastic.

Obviously, this financial situation is tied to computers, and children are indoctrinated in their use. Every child receives a government issued iPad on the first day of school. Children do not learn to write by hand but rather on a keyboard.

It is therefore no surprise that Stockholm is a self-proclaimed “smart city,” which seeks to implement information and communication technologies (ICT). Smart cities monitor citizens through strategically placed sensors, constantly watching everyone, with facial recognition technology, so you can no longer move anonymously through the urban landscape. (I remember that as one of the city’s joys, and my daughter still thinks it exists). People are under constant surveillance, so this should, at least, create a safer environment.

Advocates of “smart cities” (such as Vint Cerf) have claimed that government surveillance resembles the lack of privacy in small towns. In contrast, critics state that information sharing in “smart cities” has shifted from horizontal information flows between citizens to a vertical, unilateral process between citizen and government. That’s common sense. It’s one thing to know your neighbors, whether you like them or not. It’s another to live in the shadow of the all-seeing eye.

By the way, Vint Cerf, the “father of the internet,” holds his degree from Stanford University, a hub of MK-ULTRA mind control, and he was once a manager for the Defense Advanced Research Projects Agency (DARPA), which is responsible for my own microwave harassment.

Incidentally, there are some excellent sites regarding our fight against CIA, NSA, and DARPA below—two by Dr. Katherine Horton, an Oxford-trained particle physicist, and one by whistleblowers from the NSA.

Advocates of a cashless society often claim that concern for safety drives their push to eliminate anonymity, privacy, and economic freedom. James Pomeroy claims, “Cash carries a number of risks, such as loss, damage and theft, which aren’t as prevalent with electronic money and payments…. In Sweden, the poster-child of the cashless revolution, safety is oft cited as one of the triggers.”

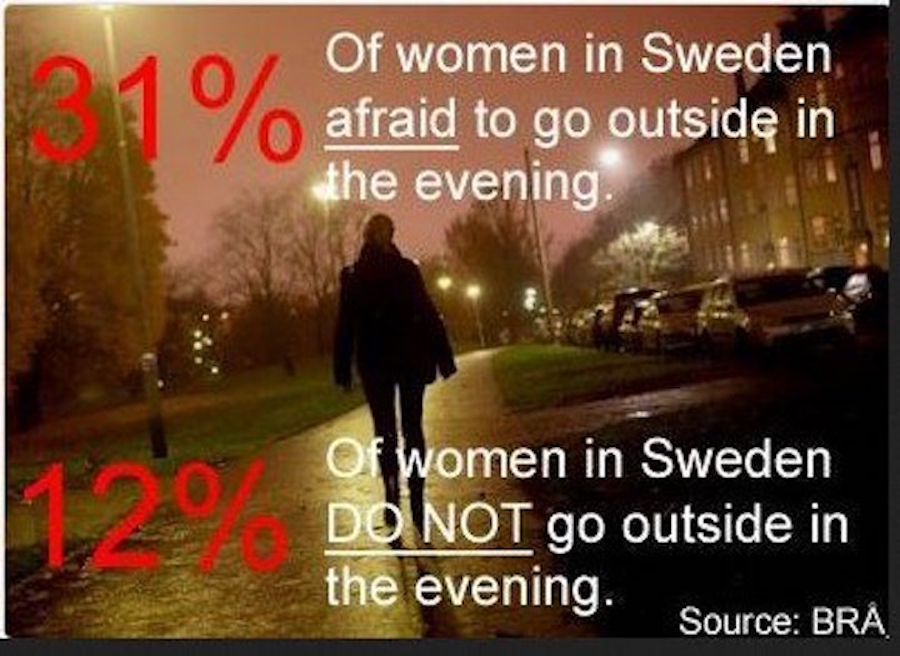

But Sweden is anything but safe. Gangs of muslim migrants rape women in the streets, and the government does nothing to stop it. This is the New World Order.

Sweden’s acceptance of muslim rapists has to do with wrong ideas, partly about multi-culturalism, itself a product of NWO. Some Swedes see themselves as open-minded and progressive, which makes them easy pickings for the scum at CIA. When we see horrific gang rapes occur so often in such a controlled environment, it becomes obvious that an invisible hand lies behind the attacks.

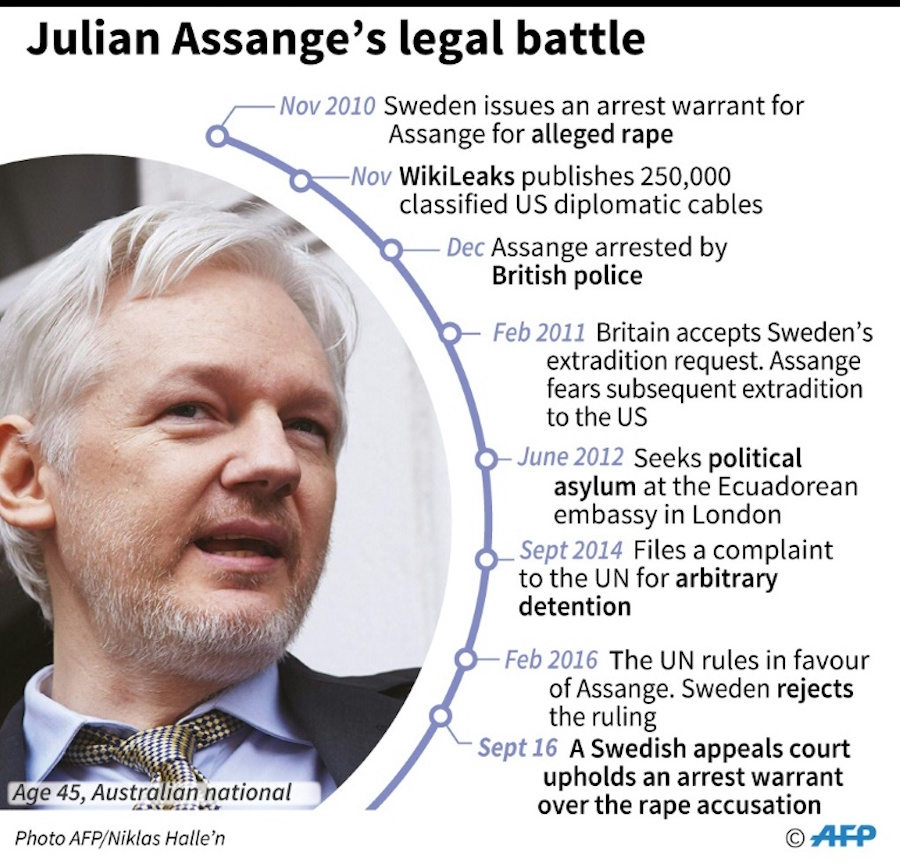

Even more striking is Sweden’s pursuit of Julian Assange, a critic of the New World Order, halfway around the world, allegedly for a sex offense, while it fails to protect its own women from unbelievably disgusting sexual assaults in public places.

But still more striking is the use of cashless banking to attack Assange’s WikiLeaks. A cashless economy is great for shutting down critics. After Assange published the biggest leaks in journalistic history, including diplomatic cables from the U.S. State Department, an arbitrary and unlawful financial blockade was imposed by Bank of America, VISA, MasterCard, PayPal and Western Union. WikiLeaks described the bankers’ attack on its finances as follows:

“The blockade came into force within ten days of the launch of Cablegate as part of a concerted US-based, political attack that included vitriol by senior right wing politicians, including assassination calls against WikiLeaks staff. The blockade is outside of any accountable, public process. It is without democratic oversight or transparency. The US government itself found that there were no lawful grounds to add WikiLeaks to a US financial blockade. But the blockade of WikiLeaks by politicized US finance companies continues regardless.”

WikiLeaks turned to BitCoin, which is a question in itself, but the point is that a cashless economy does not make a single person safe from crime. However, it does make it easy for an oppressive regime to attack critics by seizing or sequestering their assets. When you don’t have cash—and you can’t transfer funds from or to a bank—the government or the bank can easily shut you down.

The war on cash, like the war on privacy, like the horrific false flag attacks by illegal immigrants, are all staged by CIA. Their Illuminati masters, who run the banks and the so-called “intelligence” community, want us to give up cash so they can track and control us. Just as Zionist bankers made our ancestors accept fiat paper money, minted out of thin air, instead of gold; now they are making us accept computerized money instead of paper.

The New World Order tries to sell its agenda, the war on cash, through claims that cash is inconvenient. That’s jibberish—but brainwashed people accept the idea.

Brett Scott, the author of The Heretic’s Guide to Global Finance, told Sputnik News,

“It’s funny, for all the talk of cash’s inconvenience, what’s truly inconvenient is when a payment network crashes and millions can’t make any payments at all. In a truly cashless world, we’d be just one hardware failure or critical error away from not losing control over our finances until the issue is corrected—that’s likely to only be temporary, but it could still last hours, days or even weeks. Cash, on the other hand, is incapable of crashing, because its use isn’t dependent on external data centers.”

But if they can’t convince you, banks and merchants simply try to force you into non-cash transactions, claiming this lowers costs. Scott went on to say,

Shocking Discovery: What’s Going to Happen in America in the Next 24 Hours!

“One of the ways we’ve reached this point is through what behavioral economists call ‘nudging.’ Finance industry players want the public to adopt digital, so slowly make it difficult to use any alternative. For example, they start shutting down ATMs, which makes it harder to access cash, which makes digital systems thus appear relatively more convenient by default, which induces people to ‘choose’ digital. For centuries, there was no public angst at all about physical currency’s ‘inconvenience’, and I still see people use cash every day without any obvious difficulty — yet we’re constantly told it’s burdensome. This is psychological reverse-engineering.”

But let’s hear from the other side. Kenneth S. Rogoff wrote The Curse of Cash, arguing that the United States should follow Sweden’s lead. Rogoff argues that the U.S. government should phase out the one hundred dollar bill, then the fifty dollar bill, and then the twenty dollar bill. He wants to increase surveillance of all transactions, claiming that cash facilitates crime. Rogoff claims that the elimination of large bills would have the “advantage” of allowing the IRS to collect more taxes—not to mention further enabling central bankers to manipulate interest rates since holders of electronic funds could be more easily pressured by negative interest rates and other central bank schemes. That’s just what the central banks need: more power.

And who is Rogoff? He is a teenage chess prodigy, who went to Yale, where he was, almost certainly, a member of Skull and Bones. I have mentioned this obscene organization in my articles on the Bush Family, its ties to satanism, and CIA drug wars.

Rogoff served as an economist at the International Monetary Fund and the Board of Governors of the Federal Reserve.

Rogoff, who “works” as a professor at Harvard, is a member of the Group of Thirty and the Council of Foreign Relations, yet another Illuminati organization. You can listen to Myron Fagan’s lectures on the Illuminati, the CFR, and the UN’s attempt to destroy our national sovereignty below.

These scum are destroying Scandinavia, and we are next. If we can’t take Sweden back—although I hope we can—let’s at least learn from their example. We need to defend our borders against foreign immigrants, stop making excuses for criminals with dark skin, and see Islam for what it is.

We need to insist on our right to use cash. Boycott any business that insists on non-cash payments, and tell them you are doing so. Lobby your legislature for laws requiring businesses to accept cash. And use cash yourself. It’s an easy way to avoid surveillance.

Did this article resonate with you? If you'd like to see more content like this, consider supporting my work by 'SUPPORT.' Your generosity helps me keep the conversation going and the insights coming. Cheers to more enlightening reads!