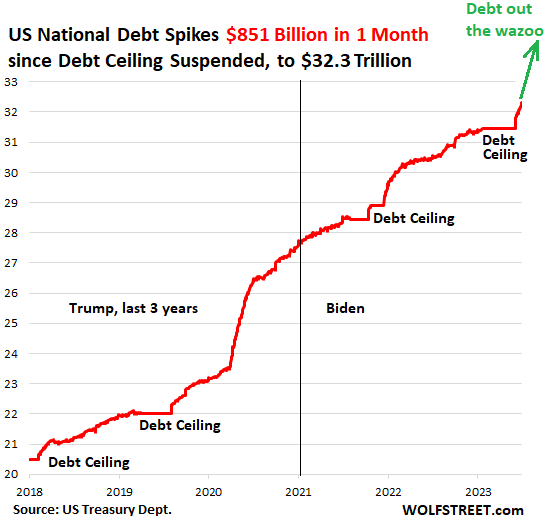

Our world is unfolding like the script for a Hollywood disaster movie. Picture this: the US Treasury’s national debt has skyrocketed by over $850 billion – a cosmic shift that has happened in just one month. Friends, we’re living in a drama that’s anything but fiction. It’s high time we take a moment to observe the puppeteers behind the curtain – the global elitists and bankers. There’s a sneaking suspicion that they’re speeding up the collapse of the fiat currency debt system.

It’s no mere coincidence.

The Congress recently suspended the federal government’s borrowing cap for two years.

The outcome?

An alarming spike in debt.

As of June 30, the national debt amounted to a breathtaking $32.33 trillion, surpassing the $32 trillion mark just a week after the debt ceiling got the green light.

At the heart of the matter is the Fiat Currency Debt System, which is inching towards a total freeze of global credit markets. This impending crisis isn’t just a little stumble – it’s a giant leap towards an economic abyss.

Fasten your seatbelts. In the short span of one month, the US Treasury managed to bloat the national debt by over $850 billion. Within a week of lifting the debt ceiling, we saw the national debt punch through the $32 trillion barrier. Goldman Sachs projected that the Treasury would need to hawk up to $700 billion of Treasury bonds to boost its cash reserves. But lo and behold, the Treasury outdid even those predictions!

Let’s put a microscope on the debt composition. Non-tradable debt saw a rise by $123 billion and tradable debt by $728 billion. The General Treasury Account (TGA) cash balances swelled to $465 billion, which though sizable, is short of the $550 billion target.

The Treasury Department, acting like a Dickensian protagonist in a world of insatiable creditors, estimates a whopping $733 billion worth of securities will have to be auctioned during the third quarter. Why, you may ask? Well, our government’s tax revenues are on a downward spiral and borrowing is their saving grace. The fiscal responsibility law’s spending cuts haven’t made a significant dent in total spending. The government’s relentless borrowing spree is drying up market liquidity.

The ripple effects of this saga are far-reaching. Rising interest rates are increasing the burden on corporate bonds, mortgages, and other debt instruments. The national debt has grown into a Herculean challenge, and servicing this debt will become a Sisyphean task if interest rates keep surging.

On the heels of the debt ceiling deal, the rate at which the US Treasury borrows money has been nothing short of remarkable, beating even Goldman Sachs’ estimate of up to $700 billion in Treasury bonds to be sold within six to eight weeks. Astonishingly, they achieved this number in just four weeks! Tradable debt rose by a mind-boggling $728 billion since June 3rd, pushing total outstanding debt to $25.43 trillion. Non-tradable debt, though lesser in volume, also spiked by $123 billion.

Despite the borrowing avalanche, the Treasury has only managed to partially replenish the General Treasury Account (TGA). This federal government’s current account saw its cash balance mushroom to $465 billion from $23 billion as of June 30. However, it still falls short of the Treasury’s target of $550 billion and is a far cry from its optimal balance of nearly $600 trillion.

This shortfall forces the Treasury to borrow more money, thereby causing a vicious cycle. The Treasury’s predicament of selling bonds is unnerving. The third quarter may demand the sale of $733 billion worth of securities to cover current expenses and pad the TGA. However, the pressing question is – who will buy all these bonds? With the Fed already wrestling with inflation, it can’t whip up demand through quantitative easing, at least not presently.

The Treasury will have to hawk bonds at lower prices and higher yields to lure enough demand to soak up the supply. This approach, however, would trigger higher interest rates, spelling disaster for governments looking to borrow trillions of dollars. The national debt has transformed into a ticking time bomb, primed to wreak financial mayhem.

The surge in Treasury lending will significantly bleed the market dry of liquidity. This scenario is a stark contrast to the recession phase. As liquidity gets sucked out, it ramps up interest rates on various debt instruments like corporate bonds, mortgages, and auto loans. The fallout of this liquidity drain and mounting interest rates are yet to fully unveil themselves, but they’re guaranteed to leave deep scars on global credit markets.

Here’s a bitter pill to swallow. The national debt, a crisis of epic proportions, has become a topic of indifference to many. The discussions of debt often get brushed aside as a problem of the distant future. This casual disregard is misplaced. The road to disaster is much shorter than anticipated, and the repercussions of debt willsoon rear their ugly heads, spiraling us into an economic apocalypse of unprecedented scale.

Let’s take a moment to delve into why an excessive national debt poses such a colossal risk to global credit markets in the Fiat Currency System.

The government’s finances are under a tremendous strain due to the burgeoning national debt. As the debt inflates, the government has to borrow more to cover the debt, thereby hiking the debt-to-GDP ratio. This scenario raises alarm bells among investors and creditors about the government’s ability to repay debt and potentially chips away at confidence in the fiat money system.

The crowding-out effect is another beast altogether. High government debt levels necessitate a sizeable chunk of the budget to be earmarked for interest payments. This shrinks the funding available for vital public services, infrastructure development, and social programs. When government borrowing redirects money away from the private sector, it constricts credit availability for businesses and individuals, potentially leading to a credit crunch and stunting economic growth.

Here’s another domino effect – excessive national debt can erode investor confidence in the stability and health of a country’s economy. Investors, wary of the risk of default or currency devaluation, may pull back from government bonds and other debt instruments. Consequently, governments may grapple to find bond buyers, leading to higher borrowing costs and potentially freezing global credit markets.

The plot thickens with rising interest rates. As national debt balloons, governments become increasingly reliant on domestic and foreign investors’ borrowing. If investors perceive a heightened risk associated with the debt, they may demand a higher interest rate to compensate for the added risk. This creates a vicious cycle, wherein higher borrowing costs exert more pressure on government finances, making debt repayments more challenging. These rising interest rates can ripple out to impact consumer borrowing costs, mortgage rates, and business investment, further throttling economic activity.

We mustn’t ignore the systemic risk posed by excessive sovereign debt within the financial system. When governments rely heavily on borrowing to fuel their operations, shocks or disruptions to credit markets can have severe repercussions. A global credit market freeze could lead to liquidity shortages, disrupt business operations, limit individuals and businesses’ access to credit, and potentially trigger a financial crisis.

Lastly, the lack of public confidence is a critical factor. In a fiat money system, where the value of money is not backed by a real commodity but by people’s trust, excessive national debt undermines this trust.

The risk of a global credit market freeze stems from the interdependence of economies and financial systems around the world. Therefore, it is of utmost importance that governments adopt a responsible approach to managing national debt levels to ensure the stability of global credit markets and safeguard the overall soundness of the fiat currency system.

Fellow citizens, the truth is written in clear, bold letters: We’re sitting on a ticking time bomb, and the clock is ticking faster than ever.

It’s time to take the reins before the national debt horse bolts, and we’re left in an economic wasteland.

The pen is in our hands – it’s up to us to rewrite the end of this looming disaster story.