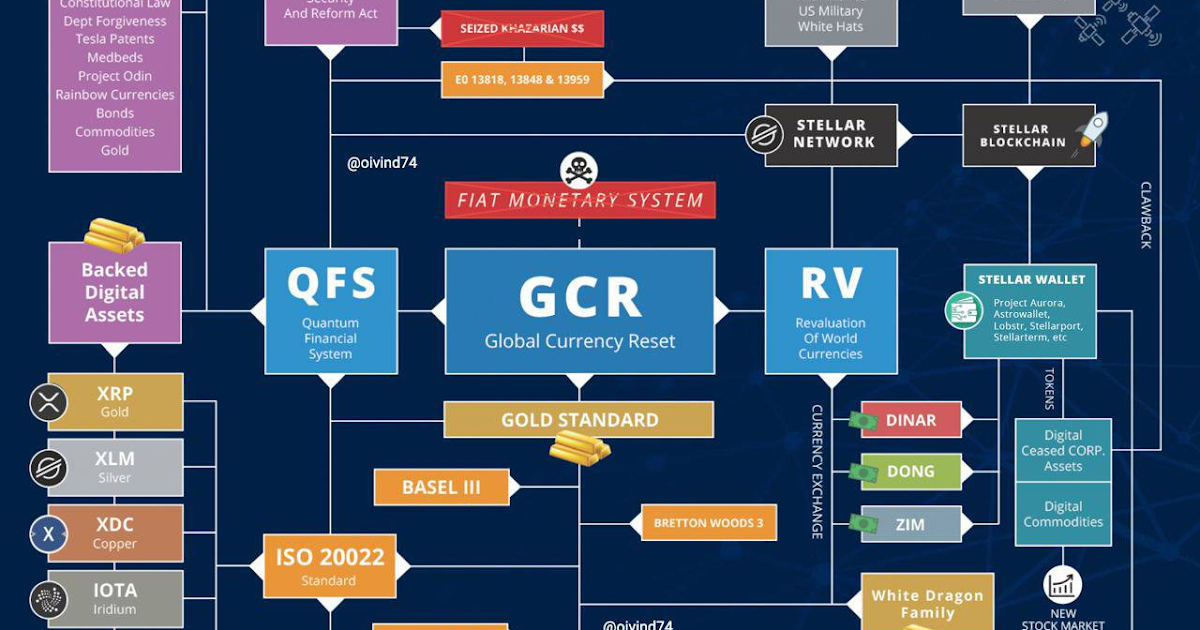

Amidst the clatter of the global financial markets, a seismic shift is unfolding, largely unnoticed by the mainstream media. The movements related to the Global Currency Reset (GCR) and Revaluation (RV) are gaining unprecedented momentum, marking what could very well be the dawn of a new economic era. As we peel back the layers of public information and clandestine developments, the contours of a financial revolution begin to emerge, challenging the very foundations of the current global economic order.

On March 3rd, Japan time, a plethora of events and trends tied to the GCR/RV have been confirmed, painting a picture of a financial landscape on the cusp of radical change. The Central Bank of Iraq’s recent announcement to launch “5 Types of Currencies” in foreign trade transactions, effectively sidelining the US dollar, is nothing short of revolutionary. This move not only signals a bold step towards diversifying global trade mechanisms but also underscores a deliberate push to revalue the Iraqi dinar, potentially turbocharging its position in the international financial system.

The transition towards electronic payments in Iraq marks another significant stride in this direction. By promoting digital transactions and reducing the reliance on cash, Iraq is not only streamlining its financial infrastructure but also setting the stage for a more robust valuation of its currency. This shift, while seemingly technical, carries profound implications for the Iraqi economy, potentially catalyzing a dramatic revaluation of the dinar.

Must Watch! – The Ancient Frequency Fueling the New Financial System – A Step-by-Step Guide to Harnessing Its Power for Personal Wealth!

Parallel to these developments, whispers of “New U.S. Notes (USTN)” have been reverberating through the corridors of the U.S. financial industry. The rumored introduction of these notes, stored away in the vaults of American banks, points to a covert preparation for a monumental shift in the U.S. monetary system. The piecemeal distribution of information regarding the USTN, coupled with the strategic ambiguity maintained by financial insiders, hints at the magnitude of the changes afoot.

The convergence of these events is no mere coincidence. Rather, it suggests a coordinated effort to recalibrate the global financial architecture, challenging the hegemony of the US dollar. The implications of such a shift are staggering, promising to redefine the economic relations between nations and the very fabric of international trade.

Critics might dismiss these developments as isolated incidents, but the evidence suggests otherwise. The decision by Iraq to diversify its trade currencies and embrace digital payments, the cryptic rollout of the USTN, and the deliberate silence of those in the know all point to a carefully orchestrated plan. This plan, shrouded in secrecy and executed with precision, could very well herald the advent of a new economic order.

As this narrative unfolds, the silence of mainstream media is deafening. The lack of coverage, the absence of debate, and the seeming indifference to the seismic shifts underway are indicative of either a gross underestimation of the events or, more sinisterly, a deliberate attempt to keep the public in the dark. The reasons for this silence are as yet unclear, but the implications of these developments are too significant to ignore.

The global economic landscape is on the brink of a transformation that could redefine power dynamics, alter national fortunes, and challenge the dominance of the US dollar. As we stand on the cusp of this new era, the movements related to GCR/RV offer a glimpse into a future fraught with uncertainty but also brimming with potential.

The time for complacency is over. The signs are clear, the movements are gaining momentum, and the implications are profound. The question is, are we ready for the world that lies ahead?